| Your browser does not display parts of our website correctly. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: |

Eco Wave Power Global AB (publ) (WAVE), a wave energy company, engages in the development of a wave energy conversion (WEC) technology that converts ocean and sea waves into clean electricity.

The company also holds various agreements comprising power purchase agreements, concession agreements, and other agreements worldwide with pipeline of projects with approximately 404.7 megawatts.

The company also holds various agreements comprising power purchase agreements, concession agreements, and other agreements worldwide with pipeline of projects with approximately 404.7 megawatts.

It has operations in the United States, Sweden, Israel, the British Overseas Territory of Gibraltar, Greece, Portugal, China, Australia, and internationally.

The company was formerly known as EWPG Holding AB (publ) and changed its name to Eco Wave Power Global AB (publ) in June 2021. Eco Wave Power Global AB (publ) was founded in 2011 and is headquartered in Tel Aviv-Yafo, Israel.

Entry Point: $11.00

Trading Range: $1.01 - $12.39

Stop Loss: $10.45

Target Price: $12.00

NuScale Power Corporation (SMR) engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications.

It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

The company was founded in 2007 and is headquartered in Portland, Oregon. NuScale Power Corporation operates as a subsidiary of Fluor Enterprises, Inc.

Entry Point: $18.00

Trading Range: $1.81 - $20.35

Stop Loss: $17.25

Target Price: $19.75

Alpine Immune Sciences, Inc. (ALPN) operates as a clinical-stage immunotherapy company.

It focuses on creating various immunotherapies through protein engineering technologies for autoimmune and inflammatory diseases.

It focuses on creating various immunotherapies through protein engineering technologies for autoimmune and inflammatory diseases.

The company has strategic collaborations with biopharmaceutical companies and has a pipeline of clinical and preclinical candidates in development.

Its pipeline includes Povetacicept, a dual B cell cytokine antagonist for multiple autoimmune and inflammatory diseases; and Acazicolcept, a dual inhibitor of the CD28 and ICOS T cell costimulatory pathways for treatment of severe inflammatory diseases. Alpine Immune Sciences, Inc. was incorporated in 2007 and is headquartered in Seattle, Washington.

Please note, this stock reported earnings on Monday, March 18th.

Alpine Immune Sciences reported earnings of $0.15 per share on revenue of $30.85 million for the fourth quarter ended December 2023. The consensus estimate was a loss of $0.32 per share on revenue of $9.10 million. The company beat consensus estimates by 146.88% while revenue grew 1,011.42% on a year-over-year basis.

After a strong earnings report, shares should head higher.

Entry Point: $40.00

Trading Range: $6.39 - $42.24

Stop Loss: $38.00

Target Price: $44.00

ALPN closed at $64.15

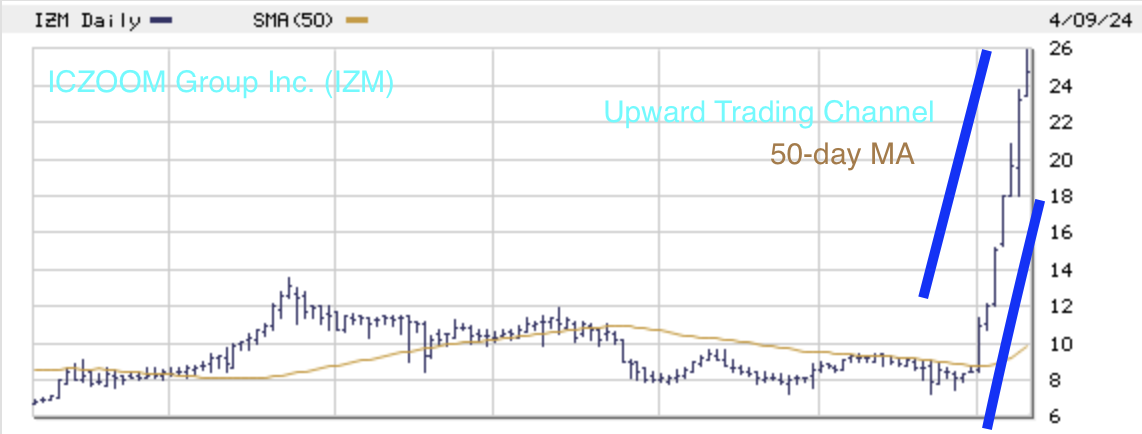

ICZOOM Group Inc. (IZM), together with its subsidiaries, sells electronic component products to customers in Hong Kong and the People's Republic of China.

The company provides semiconductor products, including various integrated circuit, discretes, passive components, and optoelectronics; and equipment, tools, and other electronic component products comprising various electromechanical, maintenance, repair and operations, and various design tools. Its products are used by small and medium-sized enterprises in the consumer electronic industry, Internet of Things, automotive electronics, and industry control segment.

The company provides semiconductor products, including various integrated circuit, discretes, passive components, and optoelectronics; and equipment, tools, and other electronic component products comprising various electromechanical, maintenance, repair and operations, and various design tools. Its products are used by small and medium-sized enterprises in the consumer electronic industry, Internet of Things, automotive electronics, and industry control segment.

The company sells its products through its online platform. It also offers customs clearance, temporary warehousing, logistic, and shipping services.

The company was formerly known as Horizon Business Intelligence Co., Limited and changed its name to ICZOOM Group Inc. in May 2018. ICZOOM Group Inc. was founded in 2012 and is headquartered in Shenzhen, the People's Republic of China.

Entry Point: $24.00

Trading Range: $1.72 - $25.96

Stop Loss: $22.80

Target Price: $26.40

Flex Ltd. (FLEX) provides design, engineering, manufacturing, and supply chain services and solutions to original equipment manufacturers in Asia, the Americas, and Europe.

It operates through three segments: Flex Agility Solutions (FAS), Flex Reliability Solutions (FRS), and Nextracker.

The company provides cross-industry technologies, including human-machine interface, internet of things platforms, power, sensor fusion, and smart audio. It also offers integrated solar tracker and software solutions used in utility-scale and ground-mounted distributed generation solar projects.

In addition, the company provides value-added design and engineering services; and systems assembly and manufacturing services that include enclosures, testing services, and materials procurement and inventory management services.

Further, it offers chargers for smartphones and tablets; adapters for notebooks and gaming systems; power supplies for the server, storage, and networking markets; and power solutions, such as switchgear, busway, power distribution, modular power systems, and monitoring solutions and services.

Shares have formed a bullish "cup and handle" following it's latest quarterly report. On October 26th, FLEX reported 2nd Quarter September 2022 earnings of $0.50 per share on revenue of $7.8 billion. The consensus earnings estimate was $0.41 per share on revenue of $7.0 billion. Revenue grew 24.7% on a year-over-year basis.

Guides Higher: The company said it expects third quarter non-GAAP earnings of $0.57 to $0.63 per share on revenue of $7.30 billion to $7.70 billion. The current consensus earnings estimate is $0.57 per share on revenue of $7.18 billion for the quarter ending December 31, 2022. The company also said it now expects fiscal 2023 non-GAAP earnings of $2.20 to $2.35 per share on revenue of $29.10 billion to $30.10 billion. The company's previous guidance was earnings of $2.09 to $2.24 per share on revenue of $28.40 billion to $29.40 billion and the current consensus earnings estimate is $2.14 per share on revenue of $28.10 billion for the year ending March 31, 2023.

Entry Point: $22.00

Trading Range: $13.63 to $22.24

Stop Loss: $20.90

Target Price: $24.20

ViacomCBS Inc. (VIAC) operates as a media and entertainment company worldwide.

The company operates in four segments: TV Entertainment, Cable Networks, Filmed Entertainment, and Publishing. The TV Entertainment segment distributes a schedule of news and public affairs broadcasts, and sports and entertainment programming; produces, acquires, and/or distributes programming, including series, specials, news, and public affairs; operates online content networks for information and entertainment; and streaming subscription services.

The company operates in four segments: TV Entertainment, Cable Networks, Filmed Entertainment, and Publishing. The TV Entertainment segment distributes a schedule of news and public affairs broadcasts, and sports and entertainment programming; produces, acquires, and/or distributes programming, including series, specials, news, and public affairs; operates online content networks for information and entertainment; and streaming subscription services.

This segment also operates CBS Sports Network, a 24/7 cable program service that provides college sports and related content, as well as broadcast television stations.

The Cable Networks segment creates and acquires programming for distribution and viewing on various media platforms, including subscription cable networks, subscription streaming, basic cable networks, international broadcast networks, and free streaming TV platform, as well as for licensing to third parties.

The Filmed Entertainment segment develops, produces, finances, acquires, and distributes films, television programming, and other entertainment content.

The Publishing segment publishes and distributes adult and children's consumer books in printed, digital, and audio formats; develops special imprints and publishes titles based on the products of the company, as well as of third parties; and distributes products for other publishers. This segment also delivers content; and promotes its products on its Websites, social media, and general Internet sites, as well as those related to individual titles.

Entry Point: $46.00

Trading Range: $10.10 - $46.85

Stop Loss: $43.70

Target Price: $50.60

VIAC closed at $60.75

Change Healthcare Inc. (CHNG) provides data and analytics-driven solutions to enhance clinical, financial, administrative, and patient engagement outcomes in the United States healthcare system.

Change Healthcare Inc. (CHNG) provides data and analytics-driven solutions to enhance clinical, financial, administrative, and patient engagement outcomes in the United States healthcare system.

It operates through three segments: Software and Analytics, Network Solutions, and Technology-Enabled Services.

The Software and Analytics segment offers software and analytics solutions for financial performance, payment accuracy, clinical decision management, value-based payment, provider and consumer engagement, and imaging and clinical workflow.

The Network Solutions segment enables financial, administrative, and clinical transactions; electronic business-to-business and consumer-to-business payments; and aggregation and analytics of clinical and financial data.

The Technology-Enabled Services segment provides solutions for financial and administrative management, value-based care, communication and payment, pharmacy benefits administration, and healthcare consulting.

Shares are on the verge of breaking out of their bullish "cup and handle." On November 4th, the company reported 2nd Quarter September 2020 earnings of $0.28 per share on revenue of $755.9 million. The consensus earnings estimate was $0.22 per share on revenue of $741.1 million. The company said it expects third quarter non-GAAP earnings of $0.28 to $0.33 per share on revenue of $725.0 million to $745.0 million.

Entry Point: $18.35

Trading Range: $6.18 to $18.47

Stop Loss: $17.40

Target Price: $20.19

CHNG closed at $23.86

Twilio Inc. (TWLO) provides a cloud communications platform that enables developers to build, scale, and operate communications within software applications in the United States and internationally.

Twilio Inc. (TWLO) provides a cloud communications platform that enables developers to build, scale, and operate communications within software applications in the United States and internationally.

The company's programmable communications cloud provides a set of application programming interfaces that enable developers to embed voice, messaging, and video capabilities into their applications.

The firm recently purchased SendGrid. SendGrid provides a cloud-based email delivery service that assists businesses with email delivery. The service manages various types of email including shipping notifications, friend requests, sign-up confirmations, and email newsletters.

The Company is scheduled to report its results on February 5th. On October 30th, Twilio reported 3rd Quarter September 2019 earnings of $0.02 per share on revenue of $295.1 million. The consensus earnings estimate was $0.01 per share on revenue of $287.7 million. Revenue grew 74.7% on a year-over-year basis.

The company said it expects fourth quarter non-GAAP earnings of $0.01 to $0.02 per share on revenue of $311.0 million to $314.0 million. The current consensus estimate is earnings of $0.07 per share on revenue of $322.0 million for the quarter ending December 31, 2019.

Shares have formed a bullish "cup and handle" and higher share prices are expected for this stock.

Entry Point: $122.50

Stop Loss: $117.00

Trading Range: $89.81 to $151.00

Target Price: $136.00

TWLO closed at $166.75

Carbonite, Inc. (CARB) provides backup, disaster recovery, high availability, and workload migration technology solutions in the United States.

Carbonite, Inc. (CARB) provides backup, disaster recovery, high availability, and workload migration technology solutions in the United States.

Its solutions include Carbonite Safe that offers annual and multi-year cloud backup plans for individuals or businesses; and Carbonite Endpoint Protection that protects the data, which resides on an organization's computers, laptops, tablets, and smartphones.

The company's solutions also comprise Carbonite Hybrid Backup, which protects a customer's data footprint on-premise and in the cloud and enables recovery while version history stored in the cloud safeguards against disaster; Carbonite Cloud Backup that automatically backs up data to the cloud and keeps physical and virtual systems protected with point-in-time restore; and Carbonite Onsite Backup, a flexible data protection solution, which backs up and replicates data securely across a customer's own private network.

In addition, it offers Carbonite Availability that keeps critical business systems available on Windows and Linux servers; Carbonite Recover, a disaster recovery-as-a-service solution that securely replicates critical systems from a customer's primary environment to the cloud; Carbonite Migrate, which migrates physical, virtual, and cloud workloads to and from any environment with minimal risk and near-zero downtime; and Carbonite Email Archiving that provides MailStore offerings designed to meet the specific email archiving needs of customers in terms of performance, stability, functionality, and simplicity.

The company provides its solutions through distributors, value-added resellers, managed service providers, and global systems integrators.

Shares have moved above their 50-day moving average on heavy volume. We are now hearing rumors that company is a takeover target.

Entry Point: $17.00

Trading Range: $11.86 to $35.735

Stop Loss: $16.00

Target Price: $19.00

CARB closed at $22.90

InMode Ltd. (INMD) designs, develops, manufactures, and markets minimally-invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radio frequency technologies.

InMode Ltd. (INMD) designs, develops, manufactures, and markets minimally-invasive aesthetic medical products based on its proprietary radio frequency assisted lipolysis and deep subdermal fractional radio frequency technologies.

The company offers minimally-invasive aesthetic medical products for procedures, such as liposuction with simultaneous skin tightening, body and face contouring, and ablative skin rejuvenation treatments.

It also designs, develops, manufactures, and markets non-invasive medical aesthetic products that target an array of procedures, including permanent hair reduction, facial skin rejuvenation, wrinkle reduction, cellulite treatment, skin appearance and texture, and superficial benign vascular and pigmented lesions.

InMode Ltd. offers its products directly in the United States, Canada, the United Kingdom, Spain, and India, as well as indirectly through third-party distributors internationally.

On August 13th, Inmode (INMD) reported Quarter June 2019 earnings of $0.45 per share on revenue of $38.8 million. That pushed shares of this IPO into a bullish "cup and handle formation." Higher share prices are expected for this stock. The company reports November 7th.

Entry Point: $31.00

Stop Loss: $29.50

Trading Range: $13.06 - $32.50

Target Price: $34.10

INMD closed at $41.00

StoneCo Ltd. (STNE) provides financial technology solutions that empower merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. It distributes its solutions, principally through proprietary Stone Hubs, which offer hyper-local sales and services; and technology and solutions to digital merchants through sales and technical personnel and software vendors.

As of June 30, 2018, the company served approximately 200,000 clients, which included digital, and brick-and-mortar merchants, primarily small-and-medium-sized businesses; and 95 integrated partners, such as global payment service providers, digital marketplaces, and integrated software vendors.

Shares of this recent IPO have formed a bullish "cup and handle" ahead of its earnings report on Monday afternoon. Analysts expect StoneCo earnings of 13 cents a share, up 550% vs. a year earlier, on revenue of $122.71 million, up 64% from a year ago. Higher share prices are expected for this stock. Note that Warren Buffet owns ten percent of yhr company.

Entry Point: $32.51

Stop Loss: $30.89

Trading Range: $16.14 - $34.50

Target Price: $35.76

STNE closed at $42.66

Puma Biotechnology, Inc. (PBYI) is a biopharmaceutical company.

Puma Biotechnology, Inc. (PBYI) is a biopharmaceutical company.

The firm focuses on the development and commercialization of products to improve cancer care.

Its drug candidates include PB272 (neratinib (oral)) for the treatment of early stage breast cancer, metastatic breast cancer, non-small cell lung cancer, HER2 mutation-positive solid tumors, and HER2-mutated non-amplified breast cancer; and PB272 (neratinib (intravenous)).

The company also develops PB357, an orally administered agent that is an irreversible tyrosine kinase inhibitor that blocks signal transduction through the epidermal growth factor receptors, HER1, HER2, and HER4. It has a license agreement with Pfizer, Inc. for the development, manufacture, and commercialization of PB272 neratinib (oral), PB272 neratinib (intravenous), PB357, and certain related compounds.

Shares have formed a bullish "flag" ahead of FDA's meeting on the company's brast cancer drug. The FDA has scheduled a May 24 Advisory Committee meeting for Puma’s neratinib in extended adjuvant treatment of “HER2” early stage breast cancer. In its Q1 earnings report last night, the company confirmed that “we look forward to presenting” at the May 24 meeting.

In a post-earnings research note, Citi’s analyst highlights that Puma accelerated plans for final five-year data from the ” #ExteNET ” neratinib trial to Q2 from the second half, as it will be used during the drug’s May 24 #AdComm. The analyst confirmed with Puma that additional data from the “CONTROL” prophylactic trial will also be presented at the meeting.

Notably, the analyst says he “noticed” that Puma appears to be actively hiring for commercial operations, with the company’s website now showing 18 job listings for roles within outreach, commercial supply chain, market access, reimbursement, and other areas. Though critics may interpret the news as signaling that Puma doesn’t expect to be acquired, the analyst counters that such an argument “doesn’t work too well tactically,” as the stock should gain at least 100% on what he calls an “expected positive” AdComm. Higher share prices are expected for this stock.

52-Weeks Trading Range: $27.64 - $73.27

Entry Point: $37.80

Stop Loss: $35.90

Target Price: $41.58

PBYI closed at $69.35

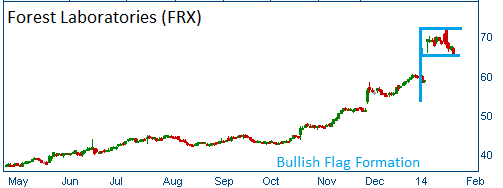

Forest Laboratories (FRX) develops, manufactures, and sells branded forms of ethical drug products primarily in the United States and Europe.

Forest Laboratories (FRX) develops, manufactures, and sells branded forms of ethical drug products primarily in the United States and Europe.

It principally offers Namenda for the treatment of moderate and severe Alzheimer's disease; Bystolic for the treatment of hypertension; Savella for the management of fibromyalgia; Teflaro for the treatment of adults with skin and skin structure infections, and community-acquired bacterial pneumonia; Daliresp to reduce the risk of chronic obstructive pulmonary disease (COPD) exacerbations in patients with severe COPD; and Viibryd for the treatment of adults with major depressive disorder (MDD).

The company has products under new drug application review by Food and Drug Administration comprising Aclidinium for the maintenance treatment of COPD; and Linaclotide for the treatment of constipation-predominant irritable bowel syndrome and chronic constipation. It also develops ceftaroline/avibactam combination, which is under Phase III clinical trials for complicated intra-abdominal infections, as well as has completed Phase II clinical trials for complicated urinary tract infections; and Cariprazine that is in Phase III clinical trials for the treatment of acute exacerbation of schizophrenia and acute mania associated with bipolar disorder.

In addition, the company develops Levomilnacipran, which is under Phase III clinical trials for the treatment of MDD; GRT 6005 that is under Phase II clinical trials for nociceptive and neuropathic pain; TTP399, which is under Phase II clinical trials for the treatment of Type II diabetes; and RGH-618 that is under Phase I clinical trials for the treatment of anxiety, depression, and other central nervous system conditions.

Shares have formed a bullish "flag" after the firm reported strong quarterly results and guided higher going forward! Higher share prices are expected for this stock.

52-Week Trading Range: $35.22 - $72.40

Entry Point: $64.95

Stop Loss: $61.70

Target Price: $ 71.44

We are taking profits on FRX. Position closed in pre-market trading at $93.15 for a 43% gain.

Select Medical Holdings Corporation (SEM) operates specialty hospitals and outpatient rehabilitation clinics in the United States. The company's Specialty Hospitals segment offers long term acute care hospital services and inpatient acute rehabilitative hospital care. This segment provides services for various medical conditions, such as respiratory failure, neuromuscular disorders, traumatic brain and spinal cord injuries, strokes, non-healing wounds, cardiac disorders, renal disorders, and cancer. As of December 31, 2011, it operated 110 long term acute care hospitals and 9 inpatient rehabilitation facilities in 28 states. The Outpatient Rehabilitation segment operates clinics; and provides physical, occupational, and speech rehabilitation services. It offers medical rehabilitation services on a contract basis at nursing homes, hospitals, assisted living and senior care centers, schools, and worksites. This segment also provides specialized programs, such as functional programs for work related injuries, hand therapy, and athletic training services. As of December 31, 2011, it operated 954 outpatient rehabilitation clinics in 32 states and the District of Columbia. We are now hearing rumors of good news for this company. One of the rumors states that this stock will be named by the leading stock advisory service as one of its "top picks." This service is widely followed by mutual funds and institutional money managers. These investors have portfolios that mimic recommendations of this service. Their naming of the stock should lead to additional demand for the shares. Shares are heading higher in a bullish "cup & handle" and are expected to move higher in this formation. The stock has a 52-week trading range of $5.48 - $11.06. Shares last traded at $10.59. Should you decide to take a position, wait for the morning volatility to wear off and use a stop-loss of $10.06 (five percentage points below your purchase price.) Be sure to use a limit order and not a market order. Keep in mind that our price target is 10% higher than your purchase price.